Discover the power of motor vehicle financing! Unlock your dream car with ease and enjoy the countless benefits it brings. Click now for a smooth ride to financial freedom.

Are you considering purchasing a new vehicle but worried about the upfront costs? Motor vehicle financing can provide you with lower upfront costs, flexible payment options, and the opportunity to preserve your savings.

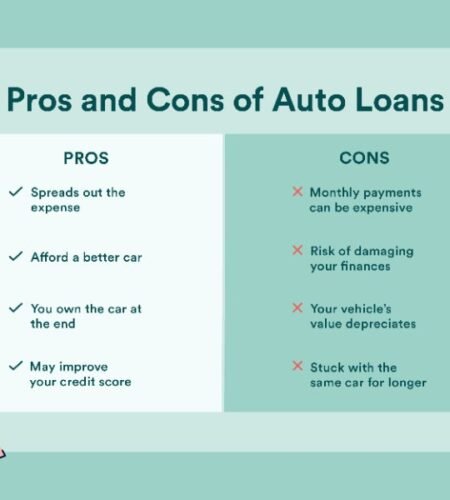

By opting for financing, you can also gain access to newer and safer vehicles, improve your credit score, and even enjoy tax benefits and deductions.

Additionally, financing opens up opportunities for future upgrades. Discover the advantages of motor vehicle financing in this article.

Lower Upfront Costs

One of the main advantages of motor vehicle financing is that it allows you to have lower upfront costs. When purchasing a car, paying the full price upfront can be a significant financial burden. However, with motor vehicle financing, you have the option to spread out the cost over time, making it more manageable and reducing your initial payment.

By choosing motor vehicle financing, you can enjoy long-term benefits. Instead of depleting your savings or tying up a large sum of money in one purchase, you can use that money for other important expenses or investments. This provides greater financial stability and flexibility.

In addition to lower upfront costs, motor vehicle financing also increases your purchasing power. Instead of being limited by what you can afford at any given time, financing enables you to choose a better-quality car or opt for additional features that enhance your driving experience. You can select a vehicle that meets your needs and preferences without compromising on quality or functionality.

With these advantages in mind, it becomes clear why many people opt for motor vehicle financing rather than paying cash upfront. It not only reduces the initial financial burden but also offers long-term benefits and increased purchasing power.

Another advantage of motor vehicle financing is the availability of flexible payment options that cater to different budgets and financial situations.

Flexible Payment Options

When it comes to motor vehicle financing, one of the key advantages is the ability to have customizable repayment plans. This gives you the flexibility to choose a payment schedule that works best for your financial situation, whether it’s monthly, bi-monthly, or even quarterly payments.

Additionally, this financial flexibility extends to buyers as well, allowing you to have more control over your budget and make adjustments as needed.

Customizable Repayment Plans

With customizable repayment plans, you can tailor your motor vehicle financing to fit your individual financial needs. Personalized terms allow borrowers to have greater control over their budget management and ensure that monthly payments align with their income and expenses.

By working closely with the lender, you can negotiate a repayment plan that suits your specific circumstances. Whether you prefer a longer term with lower monthly payments or a shorter term with higher payments, the choice is yours. This flexibility not only provides peace of mind but also empowers you to make informed decisions about your finances.

Moreover, these customizable repayment plans set the stage for the subsequent section on financial flexibility for buyers as they enable individuals to adapt their loan terms as per changing circumstances or unforeseen events without any unnecessary constraints on their budgets or financial well-being.

Financial Flexibility for Buyers

Having customizable repayment plans allows you, as a buyer, to have greater control over your budget management and make informed decisions about your finances. Here are three reasons why this financial flexibility is advantageous for you:

- Increased Buying Power: By opting for a customizable repayment plan, you can spread out the cost of your vehicle over a longer period of time. This means that even if you have a limited budget, you can still afford a higher-priced vehicle without straining your finances.

- Diverse Loan Options: With customizable repayment plans, lenders offer various loan options tailored to your specific needs. Whether you prefer fixed or variable interest rates, shorter or longer terms, there is likely an option that suits your financial goals and preferences.

- Improved Financial Planning: Customizable repayment plans provide transparency and allow you to plan ahead. You can easily calculate monthly payments and determine how they fit into your overall budget, helping you stay on track with other financial commitments and goals.

Preservation of Savings

When it comes to preserving your financial security, motor vehicle financing offers a reliable solution. By opting for flexible payment options, you can ensure that your savings remain intact while still being able to afford the vehicle you need.

Additionally, this approach allows you to preserve investment opportunities by keeping your funds available for other ventures or emergency situations.

Financial Security Maintained

By financing a motor vehicle, you can ensure that your financial security remains intact. This method allows you to maintain stability and enjoy long-term benefits. Consider the following advantages:

- Predictable Monthly Payments: With motor vehicle financing, you have the advantage of fixed monthly payments over an extended period. This enables better budgeting and planning for your expenses.

- Preservation of Emergency Funds: By choosing to finance instead of paying upfront, you can preserve your emergency funds for unexpected situations like medical emergencies or home repairs.

Investment Opportunities Preserved

Preserving your investment opportunities is key when considering the long-term benefits of financing a motor vehicle. By choosing to finance rather than purchase a vehicle outright, you open up a range of investment options that can help preserve your savings for other important goals.

Instead of tying up a large amount of money in one depreciating asset, you can allocate those funds towards investments that have the potential to grow and provide higher returns over time. Whether it’s investing in stocks, bonds, or real estate, financing allows you to diversify your portfolio and maximize your savings preservation strategy.

This way, you not only get to enjoy the benefits of owning a vehicle but also retain the flexibility to explore other investment avenues. With this approach in mind, let’s now delve into how motor vehicle financing provides access to newer and safer vehicles.

Access to Newer and Safer Vehicles

One of the advantages of motor vehicle financing is that it allows individuals to access newer and safer vehicles. This not only benefits the individual, but also has advantages for the environment and can have an impact on car insurance rates.

When you choose to finance a vehicle, you have the opportunity to get a newer model with updated safety features. Newer vehicles often come equipped with advanced safety technologies such as lane departure warning systems, adaptive cruise control, and automatic emergency braking. These features can greatly reduce the risk of accidents and injuries, providing you with added peace of mind while on the road.

Moreover, opting for a newer vehicle through financing can have positive effects on the environment. Newer cars are typically more fuel-efficient than older models, which means they produce fewer greenhouse gas emissions. By reducing your carbon footprint, you are contributing to a cleaner and healthier environment for future generations.

Additionally, when it comes to car insurance rates, driving a newer and safer vehicle may result in lower premiums. Insurance companies often take into account factors such as the age and safety rating of your vehicle when determining your rates. By choosing to finance a newer car with better safety features, you may qualify for discounts or lower insurance costs.

Improved Credit Score Opportunities

When you finance a vehicle, it can provide you with improved credit score opportunities that open up new possibilities for financial growth and stability. Here are four ways in which financing a vehicle can help improve your credit history and loan rates:

- Building Credit History: By making timely payments on your car loan, you demonstrate your ability to manage debt responsibly. This positive payment history contributes to building a strong credit profile, which lenders consider when determining loan rates for future borrowing needs.

- Diversifying Your Credit Mix: Having different types of credit accounts, such as installment loans like auto financing, can positively impact your credit score. Lenders like to see a mix of credit accounts as it shows your ability to handle different forms of debt.

- Lowering Credit Utilization Ratio: When you finance a vehicle, it allows you to spread the cost over time instead of paying upfront in cash. This reduces the amount of available credit utilized at any given time and helps keep your credit utilization ratio low—a factor that influences your overall creditworthiness.

- Accessing Better Loan Rates: As your credit score improves through responsible car loan repayment, you become eligible for better loan rates in the future. A higher credit score indicates lower risk for lenders, leading to more favorable terms and conditions when seeking loans or financing options down the line.

Tax Benefits and Deductions

By taking advantage of tax benefits and deductions, owning a financed vehicle can provide financial advantages. When you finance a vehicle, you may be eligible for various tax savings and financial incentives that can help reduce your overall expenses. One of the key tax benefits is the ability to deduct the interest paid on your auto loan from your taxable income. This deduction can result in significant savings, especially if you have a high-interest rate on your loan or if you have a substantial loan balance.

In addition to the interest deduction, there are other potential tax benefits associated with owning a financed vehicle. For example, if you use your vehicle for business purposes, you may be able to deduct certain expenses related to its use, such as fuel costs, maintenance fees, and even depreciation. These deductions can further reduce your taxable income and provide additional savings.

Furthermore, some states offer additional tax incentives for purchasing environmentally friendly vehicles or electric cars. These incentives could include tax credits or exemptions from sales taxes or annual registration fees. By taking advantage of these programs, not only will you save money on taxes but also contribute positively towards environmental sustainability.

As mentioned earlier about the opportunity for vehicle upgrades, these tax savings and financial incentives create an ideal environment for upgrading your current financed vehicle without putting excessive strain on your budget. With extra money saved through deductions and incentives, you can consider trading in your current model for a newer one with better features or improved fuel efficiency.

Overall, by utilizing the available tax benefits and deductions when financing a vehicle, you can enjoy significant financial advantages while also reducing the burden on your wallet. These cost-saving measures provide an excellent opportunity to upgrade to a more desirable and efficient vehicle without breaking the bank.

Opportunity for Vehicle Upgrades

If you take advantage of the available tax benefits and deductions, you can upgrade your financed car without straining your budget. One option to consider is a trade-in. Trading in your current financed car allows you to use its value as credit towards a new, upgraded vehicle.

When considering a trade-in, it’s important to understand how the process works. First, assess the current value of your car by researching its market price and condition. This will give you an idea of how much credit you can expect when trading it in. Next, visit different dealerships or check online platforms that offer trade-in services. Compare their offers and negotiate for the best deal possible.

Trading in your financed car has several advantages. Firstly, it eliminates the need for selling your old vehicle separately, saving you time and effort. Secondly, trading in allows you to reduce the amount of money needed for purchasing a new car since the value of your trade-in will be deducted from the overall cost. This can help make upgrading more affordable and manageable within your budget.

In addition to trading in, there are other ways to upgrade while financing a car without straining your budget. For example, some dealerships offer special promotions or incentives such as zero-percent financing or discounted interest rates on certain models. Taking advantage of these offers can significantly reduce monthly payments and make upgrading more financially feasible.

Frequently Asked Questions

Can I Finance a Used Vehicle Instead of a New One?

Yes, you can finance a used vehicle instead of a new one. There are financing options available specifically for used vehicles. Choosing a used vehicle over a new one can have several benefits such as lower cost and potential for less depreciation.

What Kind of Credit Score Do I Need to Qualify for Motor Vehicle Financing?

To qualify for motor vehicle financing, you’ll need a good credit score. Lenders typically look for scores above 600. Additionally, having a substantial down payment can increase your chances of approval and help lower your interest rate.

Is There a Minimum or Maximum Loan Amount for Motor Vehicle Financing?

There are typically minimum and maximum loan amounts for motor vehicle financing. The specific amounts may vary depending on factors such as your credit score, income, and the value of the vehicle you are purchasing.

Can I Pay off My Motor Vehicle Financing Early Without Any Penalties?

Yes, you can pay off your motor vehicle financing early without penalties. This provides several benefits such as saving on interest payments and having options for refinancing if needed in the future.

Are There Any Additional Fees or Charges Associated With Motor Vehicle Financing?

Yes, there may be additional fees or charges associated with motor vehicle financing. Some lenders require down payments and others offer the option to refinance your loan. It’s important to consider these factors when considering financing options.

Conclusion

In conclusion, motor vehicle financing offers numerous advantages for you as a buyer.

With lower upfront costs and flexible payment options, it provides the opportunity to drive your dream car without draining your savings.

Additionally, by opting for financing, you can access newer and safer vehicles, improving both your driving experience and safety on the road.

Moreover, this financial option opens doors to credit score improvements and potential tax benefits.

Don’t miss out on the chance to upgrade your vehicle with motor vehicle financing.

Subscribe to our WhatsApp channel to get the latest posts delivered right to your dm.